Our Services

Unlock Growth with Our Advanced Banking Software Development Services

Revolutionize finance with our robust banking IT services. From integrating cutting-edge core banking systems to offering advanced cybersecurity measures, our services streamline processes, reduce operational risks, and increase efficiency.

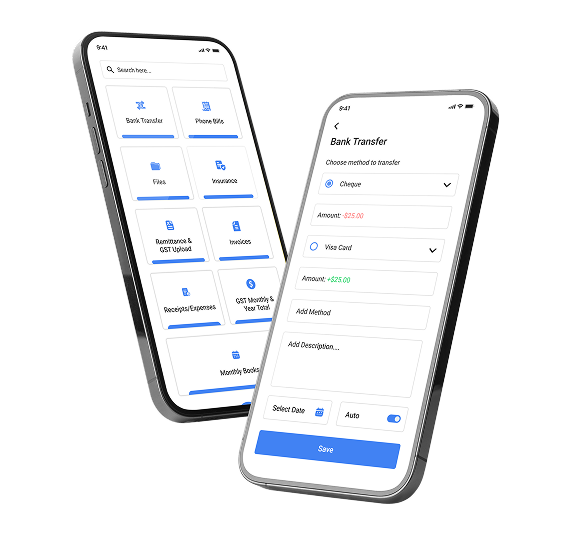

Custom Mobile Banking Software Development

Our custom mobile banking software solutions empower banks to provide secure and user-friendly mobile experiences. Whether you need a simple banking app or a sophisticated mobile platform, our expert developers tailor every feature to fit your business needs, ensuring enhanced engagement and customer loyalty.

Tailored Banking CRM Development

Our tailored banking CRM (Customer Relationship Management) systems help you manage customer interactions effectively, enhance personalization, and drive customer satisfaction. By integrating advanced features such as AI-driven insights, automation, and analytics, we enable you to offer personalized banking services that keep your customers coming back.

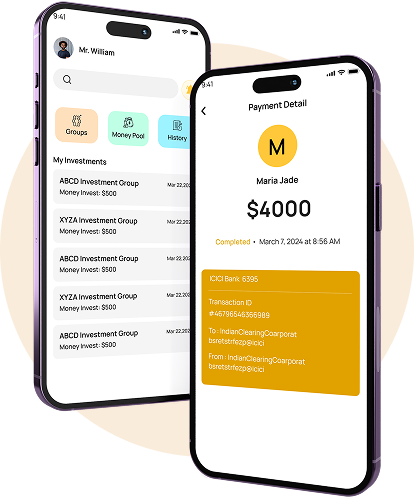

Investment Management Software Development

Our investment management software helps banks, financial advisors, and asset managers optimize portfolio management, risk analysis, and asset allocation. With real-time market data and advanced analytics, our solutions allow your clients to make informed investment decisions while simplifying your operational processes.

Payment Processing Solutions

With an increasing demand for faster, more secure transactions, payment processing is crucial to any financial institution. Our payment processing solutions ensure seamless and secure handling of payments, whether through credit/debit cards, mobile wallets, or online transfers.

Trading System Development

At ToXSL Technologies, our trading system development services provide real-time, high-performance platforms for stock, and commodities trading. We specialize in developing systems that offer seamless order execution, real-time data feeds, risk management tools, and algorithmic trading features, ensuring your clients have the tools they need to succeed in any market condition.

Banking Detection System Development

Our banking detection systems use advanced machine learning and AI technologies to detect and prevent fraud, money laundering, and other financial crimes in real-time. With automated alerts, pattern recognition, and predictive analytics, we provide banks with the tools they need to safeguard their operations and protect their customers.

12 +

Years in Business5000 +

Projects Delivered2000 +

Clients Worldwide300 +

Team MembersOur Secure and Scalable Banking Software Development Process

At ToXSL Technologies, we are committed to delivering high-quality banking IT services and solutions that enable financial institutions to innovate, stay competitive, and enhance customer experiences. Our development process is designed to ensure that every solution we provide is secure, reliable, and scalable.

Business Requirements

We collaborate closely with stakeholders to gather and analyze requirements, understand your challenges, and define the goals for the banking IT system. This phase ensures that we align our efforts with your vision, whether you're building an online banking platform, mobile banking app, or enterprise-grade solution.

App Design

Once the business requirements are clear, we focus on designing a user-centric solution. Our design team works on creating intuitive and visually appealing user interfaces while ensuring seamless navigation. We consider user experience (UX) principles, regulatory compliance, and accessibility to create a solution that enhances customer satisfaction and engagement.

Development Process

The development phase is where our team brings the design to life. Using the latest technologies, we develop secure, scalable, and efficient banking systems that meet industry standards. Whether it’s backend infrastructure, APIs, or front-end interfaces, our development process ensures the solution is robust and capable of handling complex banking transactions and operations.

Integration

In today’s digital banking ecosystem, seamless integration is key. We ensure that the banking solution integrates smoothly with your existing systems, such as payment gateways, core banking systems, third-party applications, and financial services. Our team handles data synchronization and API integrations to ensure that all systems work in harmony without compromising performance or security.

Security Measures

Security is paramount in the banking industry, and we take it seriously. Our development process incorporates advanced security measures, including data encryption, multi-factor authentication, compliance with industry standards, and regular vulnerability assessments. We build banking solutions that protect sensitive customer data and transactions from potential threats, ensuring a secure and trustworthy environment.

Testing

Before deployment, we conduct rigorous testing to ensure the banking solution is free from bugs, vulnerabilities, and performance issues. Our testing process includes functional testing, security testing, load testing, and user acceptance testing to ensure that the solution works as intended under real-world conditions. Our goal is to deliver a flawless product that meets your business and regulatory requirements.

Our Solutions

Drive Business Transformation with Cutting-Edge Banking and

Financial Software Development Solutions

Digital transformation is changing how the financial services industry operates, requiring firms to evolve quickly to stay competitive. As banks embrace digital transformation, integrating these IT services and solutions enables them to offer more personalized, secure, and efficient services for their customers. Invest in our banking IT solutions today.

Core Banking System (CBS)

A Core Banking System (CBS) is the backbone of modern banking operations. It centralizes the bank’s services, allowing for real-time processing of transactions, improved reporting, and seamless data sharing across branches. CBS ensures that customers can access their accounts and conduct transactions from any branch, simplifying account management and boosting operational efficiency.

Internet Banking

Internet banking, or online banking, provides customers with the ability to access their accounts and perform financial transactions through the bank’s website or web-based platforms. With enhanced security features, such as multi-factor authentication and encryption, internet banking empowers customers to manage their finances conveniently from anywhere in the world.

Mobile Banking Development

Mobile banking takes internet banking a step further, offering banking services on-the-go through smartphones and tablets. With mobile apps designed for both Android and iOS, customers can enjoy a range of features such as instant fund transfers, bill payments, mobile check deposits, and account management—all from the convenience of their mobile devices.

Customer Portal Development

A portal provides an intuitive, secure, and personalized gateway to banking services. Through the portal, customers can access a wide variety of self-service features such as checking account activity, managing transactions, reviewing loan details, and applying for new services. The portal can be tailored to provide customers with a customized experience, displaying relevant offers and information based on their preferences.

Banking CRM Development

A Banking CRM solution is designed to help banks efficiently manage and analyze customer interactions, aiming to build strong, long-term relationships. By consolidating customer data, CRM systems enable banks to provide personalized services, improve communication, and streamline the customer journey. With tools for tracking customer history, preferences, and feedback, CRM solutions allow banks to offer targeted marketing campaigns, improve cross-selling and up-selling, and ensure higher customer retention.

Loyalty Program Management

Loyalty programs in banking serve as a strategic tool to retain customers by offering rewards for continued engagement and transactions. With a robust loyalty program management solution, banks can design, launch, and monitor personalized reward schemes, including cashback, discounts, points accumulation, and exclusive offers. These programs not only encourage customer loyalty but also help banks differentiate themselves in a competitive market.

Enhance Software Development with a Comprehensive Technology Stack

As a leading software development company, we follow agile methods to ensure fast development and solutions that can grow with your needs. Our approach focuses on innovation, allowing us to create custom software that meets your specific requirements while adapting quickly to changes.

Microservice Architecture

Serverless architecture

Microservice Architecture

EventDriven Architecture

RabbitMQ

Metaverse

RPA

AMP

SonarQube

Elastic Search

GearMan

APIGee

SOC 2

Kong Enterprise

NLP

Deep Learning

Computer Vision

ChatGPT

Generative AI

Linear Regression

Logistic Regression

Convutional Neural Networks

NestJS

SpringCloud

Hibernate

Flask

DJango

JavaScript

TypeScript

NextJS

NuxtJS

Tailwind CSS

CSS3

HTML5

jQuery

Bootstrap

D3 JS

Ember JS

BackboneJS

Strapi

Sitecore

Sitefinity

Woocommerce

Selenium

Maven

Gradle

CIrcle CI

MS Team

Zoom

Google meet

jira

trello

Slack

Git hub

Bit Bucket

Git Lab

TFVS

base camp

Asana

insta connect

figma

XD

Illustrator

After effect

Our Portfolio

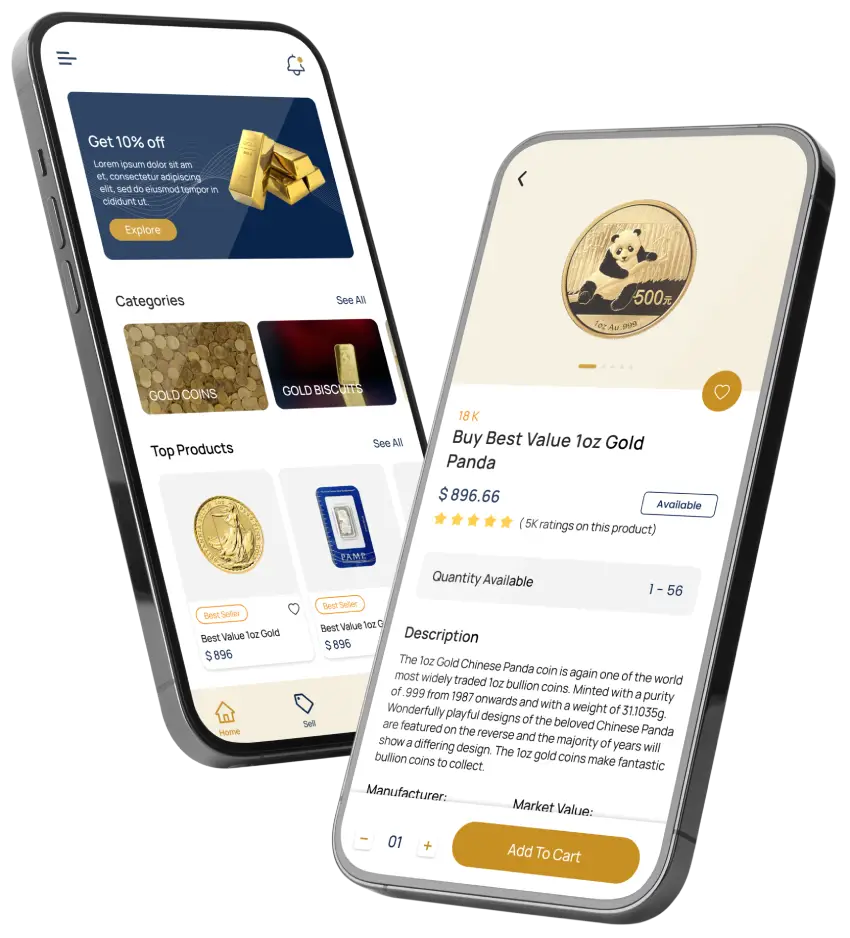

Mint Jwelles

Download the app now

Are you ready to sparkle and shine? Download Mint Jwelles, and let us help you find the perfect piece of jewelry that will make you feel confident and beautiful. Whether you’re shopping for yourself or looking for a gift, our jewelry is here to impress you.

1000k+

Downloads1.8M+

No. of Visitors

Muzlimz

Download the app now

Find love and shape the future of love and companionship in the digital age with our dating app. Whether you’re seeking a long-term relationship, casual dating, or simply want to expand your social circle, Muzlim offers a convenient and efficient solution.

1000k+

Downloads1.8M+

No. of Visitors

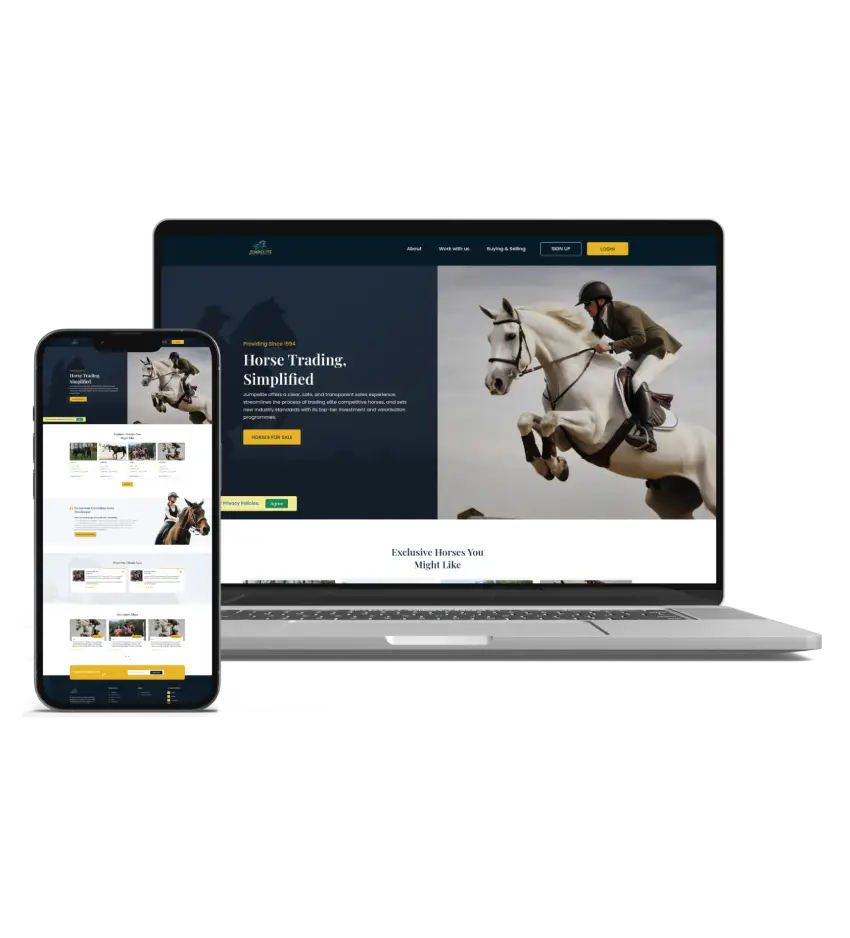

Sheikh Property

Download the app now

Whether you're looking for a new home or an investment opportunity, the real estate market is full of exciting possibilities. With low interest rates and strong demand for housing, now is the perfect time to make a move. Contact us today to learn more.

1000k+

Downloads1.8M+

No. of Visitors

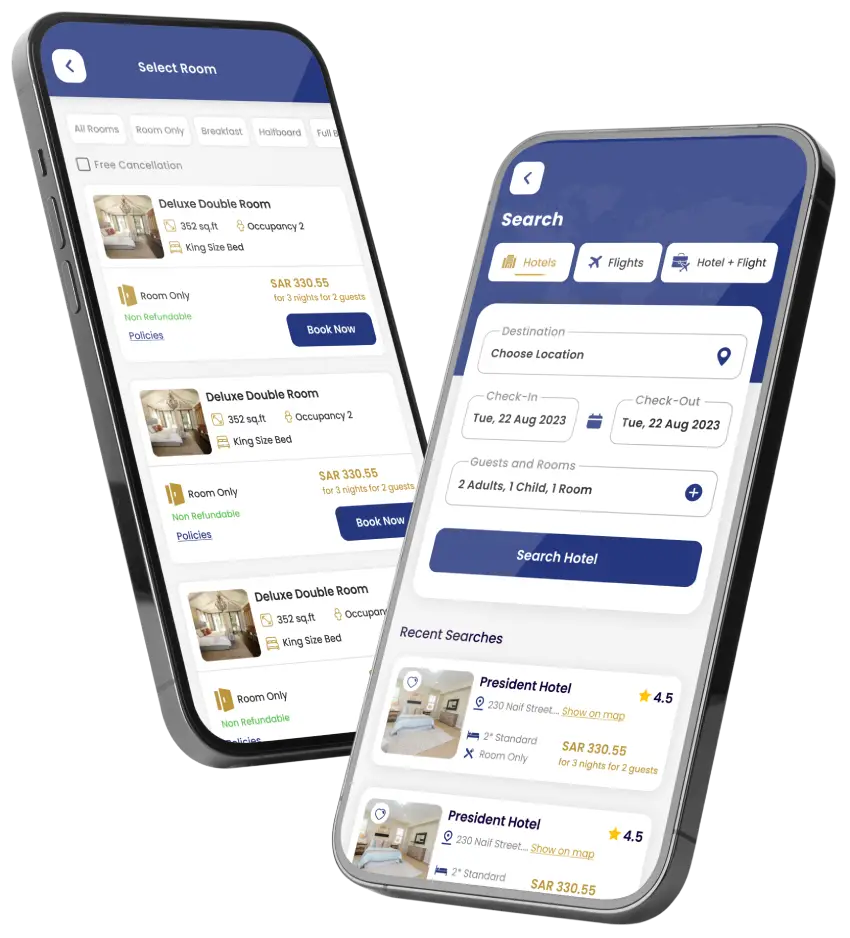

Travel Booking

Download the app now

Plan your next adventure with ease! Whether you're looking for the best deals on flights, hotels, or activities, our travel booking app has got you covered. With just a few taps on your phone, you can book your dream vacation. Plan your next adventure with us.

1000k+

Downloads1.8M+

No. of VisitorsTransform Your Business with the Most Innovative Banking Software Development.

In today’s digital age, the financial services industry is rapidly evolving, and staying ahead requires innovative technology. Our comprehensive Banking IT Services and Solutions are designed to help you modernize your operations, enhance customer experiences, and ensure the highest levels of security and compliance.

We empower banks to leverage cloud technologies for greater scalability and cost savings, while also providing innovative digital transformation tools to enhance customer engagement through mobile banking and personalized experiences.

By partnering with us, your financial institution can tap into the power of technology to meet the demands of modern banking. We’re here to help you navigate the complexities of the financial world, boosting efficiency, security, and customer satisfaction. Ready to take your bank to the next level? Let’s revolutionize finance together!

Ready to transform your banking experience with cutting-edge IT services and solutions?

Contact us today to learn how our IT services and solutions can drive productivity, growth, and customer satisfaction.

Frequently Asked Questions

Banking IT services streamline core processes, improve operational efficiency, and enhance customer satisfaction by providing better security, digital tools, and data management solutions.

Yes! Our solutions are designed to scale with your business, ensuring that as your bank grows, your technology infrastructure can expand without compromising performance or security.

We prioritize security and use the latest encryption methods, firewalls, and compliance protocols to protect your data and ensure secure transactions across all channels.

Absolutely! Our services are designed to integrate seamlessly with your current infrastructure, providing enhanced functionality without disrupting your operations.

Getting started is easy! Simply contact us to schedule a consultation, and we will assess your needs and provide a tailored IT strategy to revolutionize your banking services.